Nationally, the number of homes pending over the last few months has dropped noticeably, but has it here in the PNW? Not yet.

Real Estate Feeding Frenzy, COVID Edition

Did the frenzy slow at all in March? It seems like it will soon. But not because prices will go down. They just even out. In the hottest times, a house listed at $500,000 may go for $550,000, +/-. Just depends on how bad the buyer wants it, and how many contingencies they are willing to waive. At the higher end of the market, we see the hottest properties go for up to a MILLION dollars or more over asking. Rare, but it does happen. Mostly in markets like Bellevue, Mercer Island, and Bainbridge Island. What we don’t see is a $500,000 house going for $1,500,000. Different buyers.

What is a “Market Correction” in Real Estate?

When the market slows, it looks more like this: the $500,000 house is on the market for a little longer. Maybe instead of an offer review date after 5 days on market, there is no review date. (What?! Is that even possibly anymore?) It could be a few days, or maybe even a week or two on the market.

But let’s say that home sells at or maybe a little under asking price. Maybe it’s $495,000 if there is some item that needs fixing, like a new water heater. Would we say that “prices are falling?” Nah. Prices falling is a trend, not a one-time event. We’ll need to see the majority of homes for sale dropping prices or closing at less than asking price over a period of time–at least a few months–to really call it a correction or say “prices have fallen.”

But WILL THEY?

Will prices fall? Maybe. But it seems highly unlikely anytime soon here in the Puget Sound area.

For prices to drop, we’d need to see a lot fewer people moving to the area, and fewer highly-paid tech workers buying homes all over the area, from Bellevue to Bainbridge Island and the rest of the Kitsap Peninsula. Fewer Millennials, now in their prime household-forming years, would need to decide not to buy a home. Homebuilders will need to keep building more housing, including apartments, condos, duplexes, and single-family homes.

The supply chain issues and rising construction costs will ease eventually, but it won’t be overnight. And don’t count on the builders to immediately drop prices; they’re still recovering from the pandemic blows to their businesses, too. Check out this article for more on how homebuilding has been impacted from 2008 to now.

The recent rise in interest rates may have a major cooling effect on the market, but whether or not it will be enough to substantially cool the intensely overheated market we’ve been experiencing for the last few years is TBD. Especially when we consider all those other factors.

Our Crystal Ball Says…

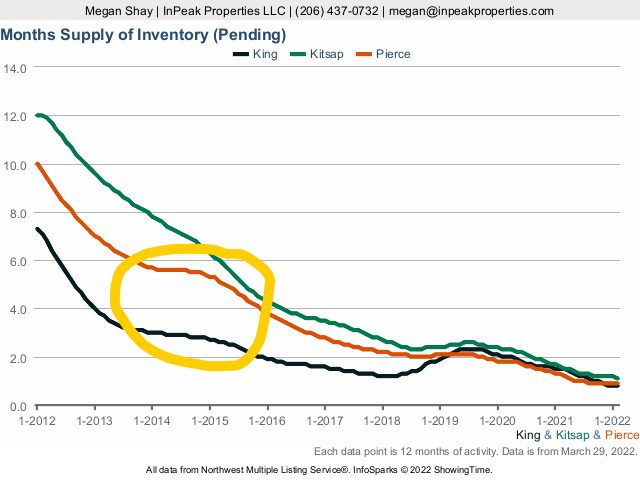

We are predicting the rest of 2022 will be a touch cooler than 2020-2021, and maybe even a little more “normal” as interest rates continue to rise and some potential buyers give up the hunt. Just remember, real estate is and always has been a cyclical business. What goes up does eventually flatten, if not go down. Just don’t blink, or you’ll miss that “normal/balanced” market. Last time we saw it was 2014-2015: